Registration for the 2025 Finance Series has been extended to October 13, 2025! If you register now, you’ll still be able to participate in the last 4 sessions live, and get a recording of session 1.

Lead with Clarity. Protect Your Mission. Empower Your Team.

Nonprofit financial leadership isn’t just about crunching numbers—it’s about building trust, sustainability, and resilience. In today’s complex funding landscape, nonprofit leaders need more than spreadsheets; they need confidence.

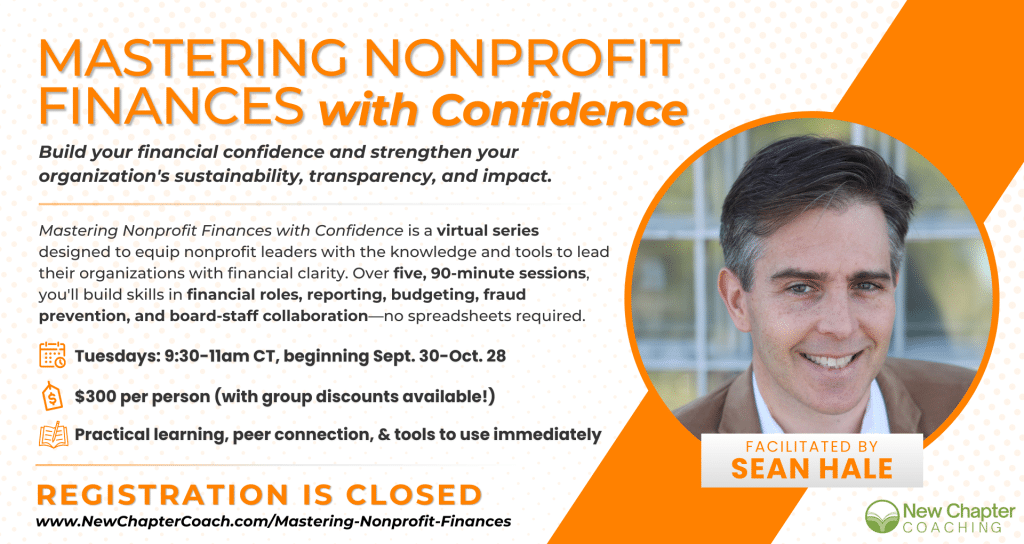

Mastering Nonprofit Finances with Confidence is a practical, leadership-focused course designed to equip any nonprofit leader—whether you’re an executive director, board member, or staff—with the tools they need to manage finances wisely, prevent fraud, and build strong cross-functional relationships. This is a 5-session series where participants will explore essential financial roles and responsibilities, read reports with clarity, and lead budgeting processes with strategy and transparency.

Each session blends insightful presentations, interactive Q&A, and small-group discussions to help participants connect concepts to their day-to-day work. You’ll also receive resources such as tools, short readings, and reflection prompts between sessions to help reinforce key ideas and apply them to your own organization.

This series goes beyond financial jargon and into the day-to-day decisions and conversations that shape an organization’s future. You’ll leave empowered to lead with foresight—and to help your team do the same.

Why Participate

Financial confidence = mission resilience.

Strong financial leadership isn’t just the responsibility of your CFO, treasurer or bookkeeper—it’s essential to every nonprofit leader who wants to protect their mission, build trust, and plan for the future.

Many nonprofit leaders feel unprepared to engage in the financial side of leadership, despite its direct link to sustainability, donor trust, and mission impact. National benchmarking shows that 1 in 3 nonprofit executives say financial literacy is a top organizational challenge—which is why this training matters now more than ever.

In this course, you’ll build real-world skills to:

- Lead financial conversations with confidence.

- Improve communication skills that strengthen your board-staff relationship around finances.

- Avoid common financial and legal pitfalls.

- Make strategic, values-aligned budget decisions.

- Reduce risk of fraud and burnout.

- Increase clarity and ownership of your financial data.

- Support organizational sustainability and growth.

Whether you’re new to nonprofit leadership or a seasoned staff or board member needing a refresh, this course will help you lead with confidence—and results.

Curriculum & Learning Objectives

Session 1— Core Roles & Duties

Clarify responsibilities. Prevent confusion. Build accountability.

You’ll learn how to distinguish the financial responsibilities of executive directors, finance staff, and board members—and how to navigate these roles legally and ethically. In this session we’ll cover:

- Legal financial duties of board members

- Responsibilities of the Executive Director, Finance Staff, Board Chair, Treasurer, and Finance Committee

- Hiring, firing, and supervising financial staff

- Fraud triangle and prevention

- Burnout and role clarity in today’s workforce

- Practice these techniques through case scenarios.

All registrants will be invited to attend this webinar live on Tuesday, September 30 from 9:30-11am CT. Have a conflict? No worries! You will also receive a recording of the webinar, made available to view for a full two weeks following the live session.

Session 2— Financial Relationships

Lead collaboratively. Align around money. Use time wisely.

Explore how internal dynamics shape financial leadership—and how to cultivate healthier relationships with money, time, and each other. In this session we’ll cover:

- Our relationship with money and time as nonprofit leaders

- Navigating the DIY trap and maximizing impact with limited resources

- Board and staff financial collaboration

- Power, authority, and communication clarity

- Engaging and leveraging your finance committee

All registrants will be invited to attend this webinar live on Tuesday, October 7 from 9:30-11am CT. Have a conflict? No worries! You will also receive a recording of the webinar, made available to view for a full two weeks following the live session.

Session 3— Demystifying Financial Reports

Understand the data. Make smarter decisions.

Understand key nonprofit financial reports, ask better questions, and engage in strategic financial conversations with confidence. In this session we’ll cover:

- Why financial reports matter

- Balance Sheet and Profit and Loss overview

- Materiality: What to prioritize

- Dashboards for strategic decision-making

- Inclusive approaches to engaging board and staff in financial reviews

All registrants will be invited to attend this webinar live on Tuesday, October 14 from 9:30-11am CT. Have a conflict? No worries! You will also receive a recording of the webinar, made available to view for a full two weeks following the live session.

Session 4— Fraud Prevention & Audits

Protect your organization. Create effective checks and balances.

Learn what truly prevents fraud—and what doesn’t. Strengthen internal controls and make sense of audit processes. In this session we’ll cover:

- What internal controls really are (and aren’t)

- Who they protect and why they matter

- Best practices for separation of duties

- Types of audits and how to select an auditor

- Why audits don’t equal fraud protection

All registrants will be invited to attend this webinar live on Tuesday, October 21 from 9:30-11am CT. Have a conflict? No worries! You will also receive a recording of the webinar, made available to view for a full two weeks following the live session.

Session 5— Budget Leadership

Lead a budget process that builds trust—not tension.

This session focuses on the leadership behind effective budgeting—not Excel formulas. You’ll gain tools to guide your team through values-based, strategic budgeting. In this session we’ll cover:

- Frugal vs. cheap: spending with purpose

- Building buy-in for tough financial decisions

- Matrix Map tool: Aligning mission and money

- Managing uncertainty: contingency planning, reserves, and wild cards

- Budget approval, timing, and communication

- COLA, deficits, and planning for surprises

All registrants will be invited to attend this webinar live on Tuesday, October 28 from 9:30-11am CT. Have a conflict? No worries! You will also receive a recording of the webinar, made available to view for a full two weeks following the live session.

Details and Logistics:

Registration:

Registration open from August 18-September 25, 2025.

Prices (for the full, 5-session series):

- Individual Registration (1-2 people): $300 per person

- Small Group Registration (Groups of 3-5): $270 per person (10% discount)

- Large Group Registration (Groups of 6-9): $240 per person (20% discount)

- Extra-Large Group Registration (Groups of 10 or more): $210 per person (30% discount)

- Special Bonus for Early Registrants: Be one of the first 10 organizations to register and receive a complimentary 30-minute strategy session with series facilitator Sean Hale! This one-on-one session is your opportunity to dive deeper into a real-time financial challenge facing your organization, explore solutions tailored to your situation, and leave with actionable next steps you can implement right away.

Meeting Times/Frequency/Format:

- (5) 90-minute sessions via Zoom

- Weekly meetings on Tuesdays, 9:30-11am CT, beginning September 30, 2025 and concluding on October 28, 2025

- Each session combines practical insights, interactive discussion, and take-home tools to help you apply financial leadership concepts to your everyday work.

- All registrants will also receive a recording of the webinar, made available to view for a full two weeks following the live session.

Who can participate?

We welcome all nonprofit leaders, including executive directors, board members, staff, and those aspiring to lead.

Meet the Facilitator:

Sean Hale has served a variety of nonprofits since 1999. During his 20 years as a nonprofit finance leader, he made improvements that reduced waste, generated new revenue, boosted staff productivity and morale, grew financial transparency, and shrank risk.

In 2020, he founded Nonprofit CFOs: now a 12-person team that helps small and medium-sized nonprofits ensure they have strong, effective financial management. Services include interim staffing, fractional CFO, bookkeeping, and indirect cost rate calculations.

Sean holds a Master’s degree, Certificate in Nonprofit Management, and a Certificate in Social Entrepreneurship.

What do Previous Participants Say?

“Great information! Great rapport with guests.”

“He kept my interest and made it enjoyable. I appreciated that Sean tailored his presentation to the audience.”

“Excellent and helpful information. Slides are GREAT! It will most definitely be useful information. I have a list of things to get started on.”